Experience & Trust

Since 1991

Decades of dedicated service to tax professionals and the industry.

Compliance & Value

100%

Of courses are IRS-approved for Continuing Education (CE) credit hours.

Professional Reach

50

States and territories reached by our students and services.

More Options for Tax Education Success

Share your knowledge through a complete suite of IRS-approved learning products designed to advance your tax career.

Online Courses

Master new tax laws and compliance from the comfort of your home or office. Build and customize your learning at your own pace. As an IRS Approved CE Provider, all courses qualify you to earn valuable Continuing Education (CE) credit hours.

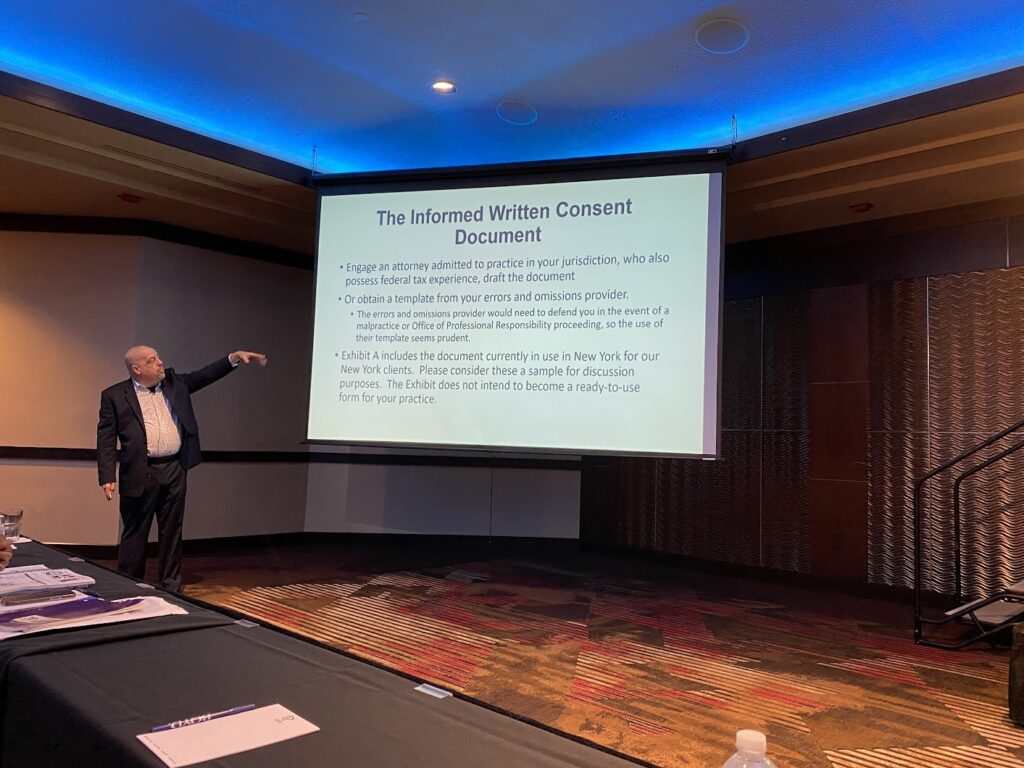

Instructor-led Training Classes

Join our expert-led classes for in-depth, interactive learning and direct Q&A. Enhance your learning with our Step-by-Step Tax Books (1040 Basics, Schedule C, Business Tax Returns, etc.). As an IRS Approved CE Provider, these classes qualify you to earn valuable Continuing Education (CE) credit hours.

ANNUAL CONFERENCE

Attend the Southern Regional Tax Conference for critical, up-to-the-minute New Tax Law Updates. Network with peers and gain an essential understanding for the upcoming tax season. As an IRS Approved CE Provider, the conference qualifies you to earn valuable Continuing Education (CE) credit hours.

Your Full-Service Ecosystem for Tax Business Success

Continuing Education & Events

Maintain Your Credentials

Fulfill your annual requirements by earning IRS-Approved CE Hours through our conferences and self-paced online modules.

TESTIMONIALS

Macy Wooden

Greenwood, Mississippi

Didra Blue-Bolton

Byram, Mississippi

Adele Harpee

Linden, Alabama

GET IN TOUCH

register @ taxclassroom.com

address

AmData Corporation

350 W Woodrow Wilson

Suite 216B,

Jackson,MS 39213

855-AMD-1040

+1 (323)-456-91-23